In this post, I’m going to show you how a financial institution, like yours, can tap into SBA loan profitability.

More specifically, we’ll go into depth on each of the following:

- what an SBA 7(a) loan looks like;

- examples of compensation on an SBA 7(a) loan;

- how your bank can find an SBA lender service provider to help.

Let’s get started.

Can a Small Bank Tap into SBA Loan Profitability?

Absolutely! In fact, from ICBA’s 2019 list of top-performing community banks with $300 million to $1 billion in assets, six of the eight most profitable banks are active SBA (Small Business Administration) lenders. These six banks boast some of the highest three-year average ROAs in their asset size.

It’s easier than you might think to get involved in SBA loan profitability. The most common SBA Loans are the SBA 7(a) loans, typically with 75% of the loan amount guaranteed by the US Government.

What does an SBA 7(a) loan look like?

|

SBA Loan Type |

Loan Size |

Interest Rate |

Borrower Down Payment |

Purpose of Loan |

Loan Term |

|

SBA 7(a)

|

Up to $5 million |

Typically, prime plus 2.75[1], but negotiable |

As little as 15% if secured by Real Estate; usually 25% for equipment |

To acquire or start a business, purchase machinery, furniture fixtures & equipment, expand or renovate a business, make improvements on leased premises, for working capital or inventory |

Up to 25 years if real estate. 10 years for business acquisition & equipment. 5–7 years for working capital. Balloon payments are not allowed for SBA loans. |

If a bank makes an SBA 7(a) loan, the bank can be compensated in three different ways:

- by selling the guaranteed portion of the loan at a premium in the secondary market[2];

- from fee income for the monthly servicing the entire loan;

- from interest income as borrower pays down the bank’s 25% portion of the loan.

Example

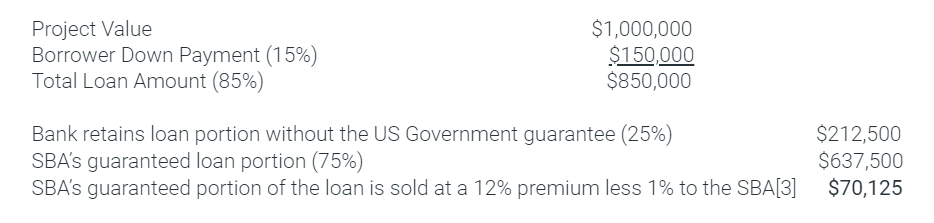

If a bank arranges SBA 7(a) financing on a $1 million project, the SBA will allow a loan for as much as 85% of the project cost when secured by real estate (usually 75% on equipment loans). The US Government guarantees repayment of 75% of the loan amount, and the government-guaranteed portion can be sold in the secondary market at a significant premium. If secured by real estate with a 25-year amortization, the value of the premium in today’s market may be around 12% of the guaranteed portion of the loan. That amounts to about $70,125[3] of additional fee income to the bank. Let me show you the numbers.

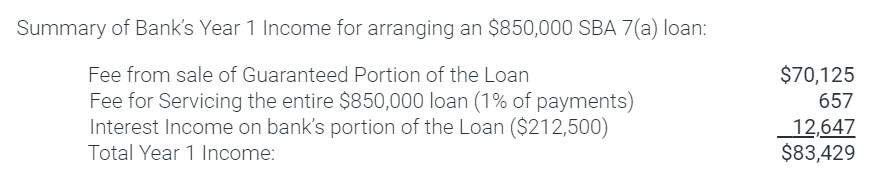

Bank Compensation #1. The guaranteed portion of the loan can be sold in the secondary market at a premium. With a $1 million project value secured by real estate, a typical 25-year financing is at prime plus 2.75% interest. In today’s market, the premium would net about $70,125.

Bank Compensation #2. The bank can receive fee income for servicing the $850,000 loan, 25-year amortization, 6% interest (assume prime at 3.25% plus 2.75%). The servicing fee would be 1% of each $5,476.56 monthly payment, or $54.77/month X 12 = $657.19/year. The servicing fee is paid to the bank for collecting and keeping record of the loan payments, disbursing 75% of the payment to the purchaser of the 75% guaranteed portion and disbursing 25% of the payment to itself for the 25% portion of the loan.

Bank Compensation #3. The lending bank is compensated with Interest Income on the bank’s 25% of the loan as the borrower makes regular monthly payments. As the $212,500 portion of the loan carried by the bank is amortized, the bank’s gross interest income year 1, less the 1% allocated for servicing the loan, would be approximately $12,413.

Finding Help from an SBA Lender Service Provider

A Community Bank without enough resources, staff, or background in the complexities of SBA lending can look outside the bank for the help needed to fill the gaps. There are many third-party SBA Lender Service Providers with deep SBA experience that can help small banks through the SBA maze, giving assistance with all SBA loan functions from beginning to end.

SBA Lender Service Providers can be identified on Google by searching “SBA Outsource Providers” or “SBA Lender Service Providers.” The help a small bank can expect from an SBA Lender Service Provider includes support with loan originating, loan closing, loan servicing, and even liquidation if actions on the loan’s default are necessary[4]. The SBA procedures limit the lender service provider's role to that of assisting lenders, while the lender maintains the ultimate responsibility for ensuring loan quality and compliance with SBA guidelines.

Notes

- If the loan interest rate is more than 2.75% over the prime rate, the guaranteed portion cannot be sold in the secondary market.

- For 25-year loans, the premium today may be 11–14%. For a 10-year loan in today’s secondary market, the SBA’s guaranteed portion of the loan may be sold for around 8–10% premium.

- If the guaranteed portion of the loan is sold for more than a 10% premium, the SBA takes half the premium amount over 10%.

- The SBA has taken steps to improve its oversight of SBA Lender Service Providers.

____________________

About the Author: Prior to joining FPS GOLD as VP of Sales in 2015, Rock Ballstaedt worked 13 years in the equipment leasing business. For 10 of those years, he operated Alpha Technology, Inc., a Salt Lake City-based equipment leasing company he co-founded, financing over $25 million/year of equipment lease transactions. rockb@fpsgold.com, 801-201-2525